Discusses Silicon Wafer Recycling business and Bright Point solar cell technology and plans

Discusses Silicon Wafer Recycling business and Bright Point solar cell technology and plans

In late January 2007, I was contacted by two first round, angel investors in Blue Square Energy (BSE), Ray Moyer, CEO of EPX (Electronic Payment Exchange), and Joseph Babin, COO of Blue Square Energy and founder of Opis Advisors. As private equity investors, Ray and Joe prefer to stay close to their investments working with the management team and adding value. And their efforts have driven change in Blue Square Energy’s approach to the press and this blogger in particular.

I’m sure my last post about Blue Square Energy, Blue Square Energy hypes impurity enriched silicon solar cells, may have prodded this decision. I reread the post before starting this article, and my fingers were singed by the printout. [Flame off!]

Over a period of two years, Blue Square Energy was financed with $5 million by first round investors to kick start a silicon wafer recycling business. Built under time and under budget, silicon wafer recycling generated a profit within 12-14 months of the commencement of operations.

Silicon wafers used for recycling into solar cells originate from the semiconductor industry. These wafers started their lives as electronic grade monocrystalline silicon ingots pulled via the Czochralski process and sawed into wafers. Per Blue Square Energy, about 10-20% of all wafer starts in the semiconductor industry are utilized for quality control of the manufacturing process creating an after market for scrap wafers. Scrap wafers can either be sold to steel and aluminum industries as metallurgical silicon or to the photovoltaic (PV) industry at a premium. Driven by polysilicon shortages for silicon solar cells, scrap wafer prices have increased from about $1.40 each (200mm wafers?) in 2004 to about $11-13 per 300mm wafer in 2007 (source: BSE).

Scrap semiconductor wafers are converted into wafers suitable for solar cell processing using a cleaning or recycling process to remove contaminates or dopants applied during semiconductor wafer processing. “Cleaned” wafers can be processed into solar cells using standard PV industry cell processing production equipment. BSE claims their recycled solar cells average about 14% electrical conversion efficiency comparable to mainstream multicrystalline silicon (mc-Si) solar cells.

Per Blue Square Energy via Mr. Moyer, here are the strengths and weaknesses of the silicon wafer recycling business for solar cells:

Advantages to using scrap semiconductor wafers:

- Cheaper than virgin wafers

- Recycling cost is minor

- High barriers to entry without established vendor relationships

Disadvantages to using scrap semiconductor wafers:

- Wafer supply (quantity & quality) is inconsistent and varies between vendors

- Recycling process requires significant engineering know-how

- World supply (market potential) is limited by semiconductor industry’s scrap supply

- Increasing foreign competition

Today, BSE manufactures up to 15,000 300mm (12 inch) and 6,000 200mm (8 inch) solar cells from recycled circular wafers per month using a single shift for annual production capacity of 2 MW (Megawatts). Blue Square Energy asserts that making solar cells from smaller recycled wafers does not make economic sense.

As I speculated in my first post about Blue Square Energy, the company is reinvesting the profits generated from the recycling business to finance a new proprietary solar technology called Bright Point.

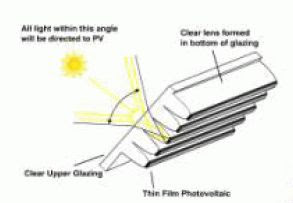

Bright Point solar cells utilize an impurity enriched metallurgical grade silicon (called UMG by BSE) substrate instead of higher quality solar grade silicon. Per Blue Square Energy, the “impurity enriched” moniker of UMG defines silicon between metallurgical grade silicon and solar grade silicon in purity.

Through a process developed by BSE, a second layer of silicon is deposited on the low cost UMG substrate. The Bright Point solar cell is designed so the active deposited silicon layer and the UMG substrate interact to achieve higher solar cell conversion efficiencies. I believe this UMC substrate forms the base of a high performance, low cost silicon solar cell approach in the Defense Advanced Research Projects Agency (DARPA) Very High Efficiency Solar Cell (VHESC) program.

At present, first generation Bright Point solar cells achieve about 10% (ten percent) conversion efficiency, and BSE believes this can be improved to as high as 14%. Blue Square Energy’s product roadmap will build upon Bright Point technology. Second generation Bright Point solar cells are targeting 20-24% conversion efficiency at an aggressive cost of $1 per Watt. BSE plans a third generation Bright Point solar cell with a whopping 25-32% conversion efficiency target.

Blue Square Energy is now developing manufacturing processes and equipment for the mass production of first generation Bright Point solar cells this year.

BSE COO Joe Babin said, "Blue Square Energy will be the first to market with a solar cell produced on a UMG substrate."

By the fourth quarter of 2008, Blue Square Energy expects to ramp Bright Point solar cell production to a 200 MWp (Megawatts peak) annual run rate. After the angel round and two pseudo series B rounds with smart money from institutional investors, Blue Square Energy has sufficient capital to commercialize Bright Point technology.

I look forward to tracking Blue Square Energy’s progress in 2007 to see if BSE can achieve their conversion efficiency targets for Bright Point in mass production. Labels: Blue Square Energy