While I was in the hall outside the standing room only Concentrating PV: Ready for Market? session (download the repeat teleconference) at Solar Power 2006, I bumped into Marc van Gerven, Vice President Marketing, with Solaria Corporation. Shutout from the session, we agreed to accelerate an afternoon interview.

While I was in the hall outside the standing room only Concentrating PV: Ready for Market? session (download the repeat teleconference) at Solar Power 2006, I bumped into Marc van Gerven, Vice President Marketing, with Solaria Corporation. Shutout from the session, we agreed to accelerate an afternoon interview. Establishing the ground rules, Solaria will not disclose details about their low concentration solar technology before they are ready for mass production. Solaria has developed an IP (Intellectual Property) portfolio of their technology, and Solaria will only disclose their technology under NDA (non-disclosure agreement) with customers, investors, and partners. Even then, I heard from sources that Solaria will only disclose their technology on a need to know basis.

The Solaria team is now setting up an automated pilot production line in Fremont, and the experience gained will quicken mass production. Products based on their technology have proven performance but need extensive validation for reliability and endurance before commercialization. Customers expect solar modules to last a minimum of 25 years with or without Solaria’s low concentration technology.

Per Mr. van Gerven, Solaria has a product centric business model; they are not an IP licensing company. Solaria will operate with a low capital investment, contract manufacturing model using manufacturing partners to produce their products. Solaria anticipates product launch in the first half of 2007.

Here is a succinct and vague description from the September 19, 2006, Solaria press release with my bold emphasis:

Solaria, based in Fremont, CA, has developed a breakthrough technology to deliver low-cost, high-efficiency solar PV solutions. The company’s unique low-concentration (2-3X) technology platform enables solar companies to produce two to three times the number of modules from the same amount of silicon material used in today’s conventional cells and modules. The company’s technology fits seamlessly into the existing PV supply chain; has the same form, fit, and function of traditional solar PV offerings; and can be deployed in a range of commercial, industrial and residential rooftop and ground-mounted applications.

More facts on Solaria’s low-concentration PV technology are revealed in this UPI article, Solar World: Concentrators in PV clothing (by Leah Krauss):

"Solaria's technology, unlike most other solar concentration technologies, does not require mirrors, moving parts, or tracking systems" to follow the sun's movement across the sky, wrote Suvi Sharma, Solaria’s CEO.

"At a systems level, the goal is to have systems where the cost of the energy produced will be 20 percent to 30 percent below that of a standard solar PV system," Mr. Sharma said.

"Additionally, we have a 5-megawatt production line in the (San Francisco) Bay Area, and will be completing our reliability test program with our partners in the field," he said.

Solaria was co-founded by Leslie A. Danziger in 1998 as a spinout company from LightPath Technologies, Inc. (NASDAQ:LPTH) which originally held a 15% stake in Solaria. Ms. Danziger was the co-founder, CEO, and Chairwoman of LightPath. Investor Relations at LightPath confirmed that Solaria’s exclusive license to proprietary GRADIUM® optics in the field of solar energy has expired.

So what low concentration technology has Solaria developed? First, it seems clear Solaria has developed an imaging or non-imaging optical solution using one half or one third as many solar cells as a standard solar module to produce the same number of Watts. A holographic optical solution is possible but would be a radical departure from Solaria’s technology roots. I suspect the Solaria solution may share principles with GRADIUM, but materials and manufacturing processes diverge. The following excerpt from a job description on the Solaria website indicates the importance of polymers:

Solaria requires a senior polymer engineer as a key member of the product development team. Solaria’s photovoltaic technology is designed for outdoor exposure in solar modules. Our photovoltaic technology contains a number of different polymers designed to provide structure, encapsulation, optics, and adhesion.

While Moser Baer’s investment in Solaria does not guarantee their selection as a manufacturing partner, I suspect Moser Baer India Limited (BOM:517140) core competencies in polycarbonate molding and thin film deposition from disc-making are significant factors behind their investment in Solaria.

Beyond speculative punditry, key questions arise about Solaria’s technology and compatible solar cell and module design.

- Are standard sized silicon solar cells compatible with Solaria’s technology or must the cells be made to specific, smaller dimensions?

- Given Q-Cells investment, do off the shelf Q-Cells solar cells work with the Solaria solution or are custom sized string ribbon cells from EverQ GmbH, a joint venture between Q-Cells AG (FRA:QCE), Evergreen Solar Inc. (NASDAQ:ESLR), and Renewable Energy Corporation ASA (OSL:REC) better suited?

- Do back contact or low resistance solar cells perform better with the Solaria low concentration solution?

- Which layer(s) of the standard solar module will Solaria’s product offering(s) replace?

- Do Solaria’s optics attach directly to the solar cells, perhaps to minimize the critical angle of total internal reflection?

By the way, Solaria was the sixth unnamed company in the Q-Cells presentation, Driving the PV industry towards competitiveness, at the 3rd PV Industry Forum in Dresden, Germany, on September 6, 2006.

Despite my best efforts to court informed sources, I have been unable to pierce Solaria’s Cone of Silence. It appears I will also have to wait for Solaria’s product launch next year, but I will keep trying.

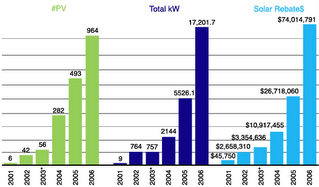

November 2006 updates are available on New Jersey’s Clean Energy Program™ (NJCEP, http://www.njcep.com) website.

November 2006 updates are available on New Jersey’s Clean Energy Program™ (NJCEP, http://www.njcep.com) website.