AstroPower: Decline of a solar photovoltaic star remains an untold tragedy?

Back in May, General Electric (NYSE:GE) announced the layoff of 85 workers and solar cell production would cease at its

As the worldwide solar photovoltaic industry expands production at a rapid pace and confronts silicon shortages and solar module demand growth fluctuations, the rapid decline of industry high flier AstroPower may provide some sobering lessons.

First, let’s review a chronicle of events leading to the bankruptcy of AstroPower and the aftermath.

July 31, 2001 - AstroPower, Inc. today announced that it has signed an agreement to acquire Aplicaciones Tecnicas de la Energia, S.A., commonly known as Atersa, a privately held company based in

August 1, 2002 - AstroPower, Inc. Reports Second Quarter Results

AstroPower stunned analysts and investors with their second quarter 2002 results. Revenue was $20.4 million representing (1%) one percent sequential growth and $4.9 million below analyst estimates, sparking nine class action lawsuits. The Stanford Law School Securities Class Action Clearinghouse has the AstroPower, Inc. Company and Case Information. The lawsuits allege that AstroPower misrepresented its financial and business status between Feb 22, 2002, and August 1, 2002. In addition to AstroPower, Inc., CEO Allen Barnett, Ph.D., and CFO Thomas Stiner are named as individual defendants.

April 1, 2003 - AstroPower delays filing of 2002 fourth quarter and annual results to the SEC.

April 21, 2003 - AstroPower, Inc. announced today that it received a NASDAQ Staff Determination letter on April 17, 2003 indicating that AstroPower does not comply with the requirements for continued listing set forth in Marketplace Rule 4310 (c) (14) as a result of its failure to timely file its Annual Report on Form 10-K for the year ended December 31, 2002 with the Securities and Exchange Commission. Accordingly, shares of AstroPower's common stock are subject to delisting from the NASDAQ National Market. As a result, the trading symbol for AstroPower common stock will be changed from APWR to APWRE at the opening of business on April 22, 2003.

May 27, 2003 - AstroPower's CEO and CFO resign

The Board of Directors then accepted the resignations of Allen Barnett, Ph.D., the Company’s Chief Executive Officer, and of Thomas Stiner, the Company’s Chief Financial Officer, from their respective executive positions with AstroPower and removed two other management employees.

July 24, 2003 - AstroPower, Inc. Announces NASDAQ Delisting

July 25, 2003 - AstroPower, Inc. Engages Bridge Associates to Provide Interim Management and Operational and Financial Consulting Services

February 1, 2004 - AstroPower, Inc. (OTC: APWR.PK) announced today that it has reached an agreement to sell certain of its

It is interesting to note that Evergreen Solar (NASDAQ:ESLR), Files Objections With AstroPower Bankruptcy Court, was also interested in acquiring the assets of AstroPower and felt the sale had not been open and fair.

March 12, 2004 - AstroPower, Inc. (OTC: APWRQ.PK) announced today the US Bankruptcy Court presiding over AstroPower’s Chapter 11 proceeding approved the sale of most of AstroPower Inc.’s US business assets to General Electric Company’s designee Heritage Power LLC. The sale price was $15 million cash plus the assumption of certain liabilities. The sale is expected to close by the end of March.

June 16, 2004 - Registrant filed a Motion with the US Bankruptcy Court in the District of Delaware announcing that it has reached an agreement to sell 100% of the equity of Aplicaciones Techicas de la Encergia, S.L.(Atersa), its Spanish subsidiary, to Elecnor, S.A., (Elecnor) a Spanish concern.

July 14, 2004 - AstroPower, Inc. announced that the US Bankruptcy Court presiding over AstroPower’s Chapter 11 proceeding approved AstroPower’s participation in the disposition by an AstroPower subsidiary of 100% of the share capital of Aplicaciones Tecnicas de la Encergia, S.L.(Atersa) its Spanish operations to Elecnor, S.A.., (Elecnor) a Spanish Corporation on July 12, 2004. The sale closed on July 14, 2004 in

December 10, 2004 - Bankruptcy or Receivership Final Plan approved.

In a final twist to the AstroPower saga, AstroPower Liquidating Trust, operated by Bridge Associates, has sued KPMG for mismanaging company audits.

So what went wrong at AstroPower? This question may remain unanswered even after all the lawsuits proceed through the courts.

Bridge Associates, the turnaround and crisis management firm brought in to salvage AstroPower, has an informative case summary regarding the still current “engagement”. Bridge Associates summarizes the AstroPower challenge as follows. “The Company discovered a substantial financial reporting misstatement which led to the departure of high level executives. The Company also faced a severe liquidity crisis caused by historical operating losses and significant research and development spending.”

Per Bridge Associates, there are apparently two dimensions to AstroPower’s demise.

1) Allegedly, the company was inflating revenues and profits in the 2002 class period and may even have been incurring losses. In the past, AstroPower had research contract revenue recognition issues. See U.S. sues AstroPower for $7.9 mln in contract dispute.

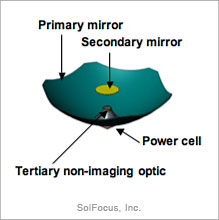

2) Most likely, although this is pure speculation, Silicon Film production was troubled and wasting company cash and material resources. GE Solar ceasing solar cell production is perhaps the best confirmation that Silicon Film continues to have unidentified manufacturing issues.

While the broad stokes of the AstroPower story seem clear, the details of misstatements, mismanagement, losses, and production issues have still not emerged.

For an uncensored view point, AstroPower fufills (fulfills ed.) legacy is an unflattering, unsubstantiated, and anonymous blog entry by a supposed, former AstroPower employee.

APWR: an electrifying experience provides an individual investor’s post mortem of his failed AstroPower investment and how to recognize the signs of trouble.

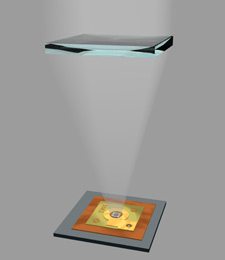

Dr. Barnett’s research and professional reputation have not been diminished by the AstroPower saga. In November 2005, Dr. Barnett, as principal investigator and research professor, was chosen to lead a broad consortium of 15 universities, corporations and laboratories, spearheaded by the University of Delaware (UDEL), to develop Very High Efficiency Solar Cells (VHESC) with 50% efficiency within the next 50 months. The Defense Advanced Research Projects Agency (DARPA) is funding the VHESC effort with up to $33.6 million of a potential $53 million research budget.

In

If you have first hand insights into the decline of AstroPower, please submit your anonymous comments or email me - confidential sources will not be identified.