SolFocus vs. Concentrix Solar: Battle of the Solar Concentrator PhotoVoltaic (CPV) start-ups

Outside of silicon shortages and Thin film solar technologies, Concentrator PhotoVoltaics (CPV) is the “hottest” topic in solar electricity and has attracted significant VC investments in 2006. SolFocus and Concentrix Solar are two of the highest profile and best funded Concentrator PhotoVoltaic (CPV) start-up companies. While both companies utilize high efficiency, Multijunction III-V space solar cells, compound semiconductors including gallium arsenide (GaAs) on germanium (Ge) substrates, their basic technologies differ as well as their research partners, solar cell partners, and management lineage.

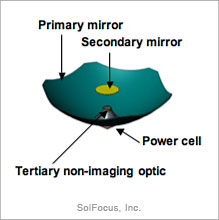

The SolFocus Gen1 (first generation) mini-dish approach has a primary mirror collect and focus direct sunlight onto a secondary mirror located on the axis at (or near?) the focus of the primary mirror as shown below. The secondary mirror, mounted to the front window, reflects the concentrated sunlight onto a non-imaging optic located directly over the solar cell. In a honeycomb arrangement, a number of mini-dishes can be packaged into a solar module with the same rough form factor as a mainstream silicon solar module, although the panel thickness is greater, driven by the focal length of the primary mirror. Professors Jeffrey Gordon and Daniel Feuermann of the Ben-Gurion University of the Negev, Beer-Sheva, Israel, developed the mini-dish approach adopted by SolFocus.

| |

| SolFocus Gen1 Mini-dish | SolFocus Gen1 solar module prototype |

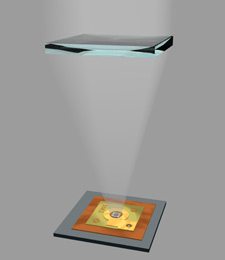

In Concentrix’s FLATCON® (Fresnel Lens All-glass Tandem cell CONcentrator) technology, a Fresnel lense concentrates direct sunlight equivalent to 500 suns through a 2mm-diameter focal point onto the solar cell. The Fresnel lenses are fabricated in a silicone film on the inside of the module top glass plate, and the entire module housing is also made of glass to avoid thermal mismatch with the different materials. The solar cells are mounted and bonded to a copper substrate heat sink which is apparently glued to the inside back of the module. FLATCON modules have 48 Fresnel lenses dimensioned 4x4 cm square and an overall height of 76mm. Fraunhofer Institute for Solar Energy Systems (ISE), Freiburg, Germany, teamed with the Ioffe Physico-Technical Institute, St. Petersburg, Russian Federation, in the early 1990’s to develop this straight forward, imaging optics based, FLATCON technology.

|  |

| FLATCON CPV cell | FLATCON solar module |

Surprisingly, it appears heat sinking is not a critical concern in either the SolFocus or Concentrix Solar module designs. Neither design requires huge heat sinks to cool the solar cells for optimal operation. Some information from Mr. Conley, CEO of SolFocus, indicates the Multijunction solar cells do not begin to approach their maximum junction temperature in typical operation with the Gen1 module design. And a small, thin copper substrate, mounted on a glass insulator, is sufficient to cool the Multijunction solar cells in the Concentrix Solar module design.

SolFocus has tipped Spectrolab as their partner/supplier for Multijunction III-V solar cells, although it is not clear which efficiency Triple Junction solar cell has been selected. Although mechanical package dimensions are not included in the online data sheets, these cells are probably available in compatible packages, so efficiency requirements and yield/price tradeoff decisions can be market driven. Spectrolab is the world leader and record holder in delivering the highest efficiency Multijunction III-V solar cells achieving 39% efficiency at 236 suns concentration. A recent Spectrolab presentation at the Advanced Solar Energy Solutions Workshop has detailed information about their products and view of CPV solar market. Last November, a SolFocus/H2Go presentation pegs Spectrolab capacity at 200MWp per year, presumably under concentration.

Concentrix Solar has been tight lipped about their Multijunction III-V solar cells partnership and sourcing plans. My recent request for clarity on this issue was politely answered by the Concentrix PR folks who said, “Concentrix Solar has no announced suppliers for the solar cells. Concerning your last questions I am very sorry but it is part of our policy that we do not make statements about partners and our integration strategy.” Fraunhofer ISE (Concentrix Solar is an ISE spin-off company) has been very active in researching and developing Multijunction III-V solar cells with long time commercial partner, RWE Space Solar Power GmbH (RWE-SSP), and this research has been included in numerous papers about the FLATCON technology. Here is a presentation, regarding Multi-junction Solar Cells in Europe research and RWE-SSP capacity, given at the November 2005 EU JRC-Ispra hosted joint workshop. RWE-SSP has capacity for 270,000 wafers (100mm) per year or 130MWp with 35% efficiency @ 500 suns and 95% production yield.

Both SolFocus and Concentrix Solar CPV solutions require sun tracking systems to acquire and maintain their focus on direct sunlight for optimal performance. Tracking systems add an extra level of complexity, cost, and their mechanical systems require maintenance. On the module specification front, SolFocus claims their Gen1 module has a “wide” acceptance angle of +/-1° trumping Concentrix Solar’s 0.6° acceptance angle. SolFocus’ larger acceptance angle implies their tracking systems can be less accurate and less expensive than Concentrix Solar.

On the cost front, SolFocus has aggressive plans to reduce the cost of their Gen1 technology from $8 per Watt in prototype volumes to $2.00 per Watt in 2007 mass production and as low as $0.55 per Watt in GWp scale production. Furthermore, SolFocus believes their Gen2 technology (to be discussed in a follow up post) can drive this cost to as low as $0.35 per Watt at GWp scale production. Concentrix Solar has outlined conservative plans to achieve a module cost of €1.23 per Watt at 20MWp production levels and fully installed costs, including the inverter, tracker hardware, and installation, of €2.35 per Watt. Per Solarbuzz, the August 2006 thin film or crystalline silicon module price per Watt varies between $4.00 and $4.15.

Both SolFocus and Concentrix Solar are targeting large solar electric installations of commercial, industrial, and power station scale. While SolFocus is optimistic about the application of their products outside the sunlight rich southwestern United States and similar sun climates depending on their price performance, Concentrix Solar believes their FLATCON modules will only be competitive in locations such as southern Europe, North Africa, or the American southwest.

SolFocus was founded in November 2005 by Gary D. Conley and Steve Horne to commercialize concentrator photovoltaic technologies (CPV) they developed at H2Go. “H2Go began in 1999 as an enabler for the hydrogen economy.” SolFocus has received $32 million in VC funding (see SiliconBeat for The VC frenzy over solar company SolFocus; VCs shower it with $32M and The VC bidding wars, and how SolFocus more than doubled its money). Gary Conley, who founded H2Go, is a serial Silicon Valley entrepreneur and the former CEO of EPRO and GuideTech. Mr. Conley is also a compulsive emailer. SolFocus plans volume production and deployments in 2007.

Concentrix Solar is a spin-off of Fraunhofer ISE and was founded in February 2005, and Dr. Hansjörg Lerchenmüller, who launched FLATCON Technology at ISE, is the founder and CEO. Good Energies, a successful investor in the solar photovoltaics industry with companies such as Q-Cells and the REC Group, has financed an undisclosed amount of first round venture capital for Concentrix Solar. Concentrix Solar has already begun delivering demonstration modules to strategic partners and plans to have a 1MWp pilot production line in place by the end of 2006.

Both SolFocus and Concentrix Solar will face traditional mono and polycrystalline silicon and thin film solar manufacturers as their prime competition, not, in my opinion, each other. Price per Watt is the key price to performance metric that will determine their competitiveness with traditional silicon and thin film solar manufacturers. In addition, I believe both CPV firms will compete for the supply of high efficiency, Multijunction III-V solar cells with other CPV technology companies. For example, the Australian firm, Solar Systems Pty, signed a multimillion dollar agreement with Spectrolab on August 14, 2006, for the initial supply of 500,000 cells (more than 11MW at Solar Systems CPV efficiencies). One reason SolFocus has received strong VC funding is to secure long term contracts with Spectrolab for Multijunction III-V solar cells. I am also concerned that both SolFocus and Concentrix Solar are single sourced for Multijunction III-V solar cells with Spectrolab and RWE-SSP respectively. In an ideal world, each company would second source their solar cells with Spectrolab, RWE-SSP, Emcore (NASDAQ:EMKR), and even Sharp Space Solar (if possible) to ensure supply and best competitive efficiency. At the moment, SolFocus has a worldwide competitive advantage by partnering with Spectrolab. In a similar vein, I am concerned about Concentrix Solar maintaining an exclusive arrangement with RWE-SSP and Fraunhofer ISE because their solar cells are third in efficiency worldwide, and RWE-SSP is “in play” as a company. RWE-SSP was acquired in May 2006 along with RWE Solutions from the RWE Group by Advent International, an equity buyout firm. A clever photovoltaic firm would make a tender offer to acquire RWE-SSP from Advent International.

In terms of competition, Sharp and Emcore are successful producers of their own Multijunction III-V space solar cells, and both have plans to commercialize their own CPV solutions. As the world leader in crystalline silicon photovoltaics, Sharp will be a formidable competitor to companies in the CPV space. Even more important, a Sharp entry into CPV will validate the market opportunity and threat to traditional silicon solutions by CPV technologies. In July 2006, Emcore announced a partnership with NREL to develop their own CPV Power Systems.

While standardization efforts for CPV applications are underway by governmental and industry organizations, CPV manufacturers such as SolFocus and Concentrix Solar need to cooperate with the CPV industry on CPV Balance of System components such as trackers and inverters. Although CPV technologies vary significantly from company to company, cooperation on module form factors, tracker techniques, and mounting methods can lower the costs for all CPV companies.

One other point regarding compound Multijunction III-V solar cells needs attention. Gallium arsenide materials are considered to be highly toxic and carcinogenic. I suggest both SolFocus and Concentrix Solar proactively setup pre-funded take back programs, similar to the model developed by First Solar, for their solar modules with independent third parties. Solar electricity is meant to be green and beneficial to the environment; pre-funded take back programs ensure this goal.

GP Note: I expect this is the first in a series of posts regarding SolFocus, Concentrix Solar, and other CPV technologies and firms.

11 Comments:

I'm sure you're also aware of Energy Innovations--not quite as attractive as SolFocus or Concentrix, but nonetheless an interesting group.

-jt

http://www.energyinnovations.com/

Energy Innovations has a novel variation on the mirror focusing system with sun tracking mirrors. There are 36 or more companies developing CPV products per Robert McConnell at NREL.

Congratulations on the quality of the analysis.

You should check out www.pyronsolar.com if you haven't already. I for one would be extremely interested in your analysis of that technology. I think it's a category-killer but what do I know.

If you want to give me a plug: I am retailing GaAs TJ cells from RWE (now Azur) conveniently mounted on a copper heatsink. Target market: researchers and hobbyists.

Online store is at:

http://www.solarhome.com.au

Very good analisys !

One minor correction, SolFocus optical design is a sophisticated imaging cassegrain like design, without a non-imaging element.

I beg to differ with the last comment regarding the optics being "imaging". The article has included a sketch from SolFocus that labels the tertiary optical element as "non-imaging". I will believe SolFocus, especially since their optical consultants include Dr. Roland Winston (father of non-imaging optics) and Dr. Jeffrey Gordon and Dr. Daniel Feuermann at Ben-Gurion University of the Negev. The latter two fellows conceived of the concept using non-imaging optics mounted to the solar cells. The concept was further developed at Drexel University in Philadelphia and then refined at SolFocus in Palo Alto, California. I worked with all 3 groups on each version and know for sure that non-imaging optics are utilized. That is how you can design for +/- 1 degree tracking accuracy (the sun's image in the sky is a subtended 0.5 degree angle on earth).

Can solar dish stirling engine compete with CPV systems being produced by these companies? If yes, on what grounds?

Stirling dishes compete in a different market if these go on rooftops, but if they are to be used in large farms, then the stirling dish has almost 80% efficiency.

However the Stirling dish, and especially the engine have their own issues of reliability and moving parts to worry about, which are far more complicated than any CPV design.

It will be for the market to decide really...wherever you see wise investors put their money, you will see the better choice...usually.

Cheers! www.thebigleaf.com

P.S. we are looking for CPV panels to work with on a very small scale.

It is my impression that Amonix is largest / best / most proven in the space. They have had systems in production for a long time with APS and others. -Brian Robertson (brian@sunworksllc.com)

SolFocus is not meeting their targets by a long way. They claimed 2 dollars per Watt installed around 2007. Well it's 2009 now and their projects go for more than 10 dollars per Watt. Even with a big profit margin and the low dollar value (compared to the Euro) that doesn't add up.

These guys are the most expensive free field PV producers in the market.

Gunther are you still tracking CPV development and availability ?

-js

Please visit the labels SolFocus and Concentrix for the most recent posts.

Post a Comment

<< Home